Tesla [TSLA] Stress me out

![Tesla [TSLA] Stress me out](https://www.prudentpressagency.com/wp-content/uploads/2020/09/1599727656_464_Tesla-TSLA-Stress-me-out.jpg)

10 September 2020 by Frugal Mughal

Note: None of the below is investment advice.

At the end of the day on September 8th, I checked my phone and learned that my stock portfolio had taken the biggest hit for a single day in my entire life. My value on paper has decreased by five digits, which is greater than any one day drop I suffered even at the start of the epidemic.

Prior to this point, even though I had had investments in the stock market for over 20 years, I generally focused my investments on incredibly stable companies that were focused on regular, substantial and less profitable profits. I made – and learned from – some incredibly bad early choices during the dotcom bubble, but since I was so early in my life, I was putting together money to save because I worked minimum-wage jobs in high school, so I didn’t. We have a lot of money to invest that would otherwise be lost.

However, Monday, September 8th, was a loss of five-digit cards, and I found myself questioning my investment.

Aside from investment tips

Before continuing, I seem to have had an interesting follow up from commentators on my articles recently. After my last articleI had someone mentioned that I should really add a clearer disclaimer – I think that at the top and bottom of that article wasn’t enough, so why not add another mention? …

Let’s be clear. If you are an investor, or are considering investing, you came and read one article on any website and then invested all your money in one investment, You’re doing it the wrong way. I am actually teaching this now to my 10 year old son, who has decided he wants to start investing. His method is for things like “Best Google Stock to Buy Today” before he excitedly tells me that someone with a $ 1.77 stock could go up 311%, and can he buy that company?

And seriously, if you search on Google, you will find the exact company. The question, as I mentioned before, is what is the point of writing an article like this? If I look at the company being advertised, by the way, we discover that the stock of $ 1.77 has lost about 25% since that point, so the drive to invest is not working. So why do they do this?

If it’s not clear, then I’m not mentioning the company because I don’t want to give it any credibility. But any sane reader should ask the same question about every website they read that contains stock information. In theory, I could be just a dummy (obviously, I am Not Sock puppet) trying to raise my stock price to sell and dump it.

Generally speaking, if you are a smart investor looking to invest in any particular company, you should actively look for both positive ones. And negative Views and their weight.

Actually, when I suggested Write to CleanTechnicaAnd I was actually doing all this research, and diving in All Articles and an attempt to define the forest through trees. I was expecting to find things about the Tesla that I loved, and things I just didn’t like. Actually, I wrote an article about it, and How surprised I found out that I did not find much support for negative opinions. Your mileage may vary, and you should never read a single article expecting to give you perfect investment advice. If you do it, you are doing it wrong.

What changed in Tesla?

With that out of the way, let’s get to Tesla. In late March, I wrote an article about my assessment of Tesla (or any company) that has been affected by COVID-19, and I specifically identified eight points that I use to decide whether or not to invest in the business.

Before I check my point for Tesla today, I wanted to point out that this is literally what I do for every company. A lot of analysts who have been concerned about Tesla like to compare it to the industry’s P / E, or the support and wedge levels in the stock charts, or … a lot of different things. Through my early investments, I learned that if the company has a premium higher than what people think the industry in which it operates, as long as it continues to perform, it will continue to earn that premium. On the contrary, the support level of the stock chart will not hold if the company faces major problems. By all means, feel free to disagree with this and create your own, but it has really worked for me for the past 20 years, since the dotcom bubble made me take a step back and find out what I’ve been doing.

Let’s examine these points:

Company leadership

Elon Musk may be polarizing to the general public, but his drive and determination have clearly established an environment of innovation and progress within Tesla’s engineering teams, and the rest of the management team seems to have facilitated a lot over the past few years. The fact that I see the continuation of the culture means that I am more comfortable leading the company.

Executive salary

Elon Musk’s stock package is unique, but it’s almost entirely driven by the company’s performance. I have no problems with this type of compensation, and it is much better for me than the multi-million dollar packages that are unrelated to company performance that many other companies give executives to.

Relevant, this is where I feel like there is a disconnect from the reporting and the real world. I can still see articles rated how much net worth Elon Musk has earned from a good day, but since Musk doesn’t sell it all in stock, the actual value won’t be until that stock is sold. This is important, as Musk’s net worth is almost on paper, not wealth he has in the bank. Additionally, Musk could not sell all of his shares without causing too much value havoc, which means his assets are illiquid or not easily convertible into cash.

When it comes to Tesla’s value, the game’s biggest and most well-known shareholder is also the CEO, who is mainly compensated only when he increases the value of those shares to both himself and all the shareholders.

If it’s not clear, then me Love Mask Executive Salary Structure. The rest of the company is more benchmark, but it’s also related to performance, as Musk won’t keep people who haven’t performed.

There are no share buybacks

Even in established companies, share buybacks are probably my biggest red flag. In theory, with stock buybacks, I end up owning a little more of the company, as a shareholder, but I feel it’s often done to support a share price that probably shouldn’t be the same, when it’s often the same time making excuses. To give executives greater cash rewards. I don’t like any of this.

I would rather the incumbent bring in additional profits as dividends if it has nothing new to invest in. With a company like Tesla, I’d rather see it increase shares in the market if it had a plan. In fact, Tesla has just sold an additional $ 5 billion in equity since the start of this month. I expect $ 5 billion in cash to be sufficient to fully fund Giga Texas. Love this step, and I’ll be glad to hear that we’ll do it again.

Long-term planning

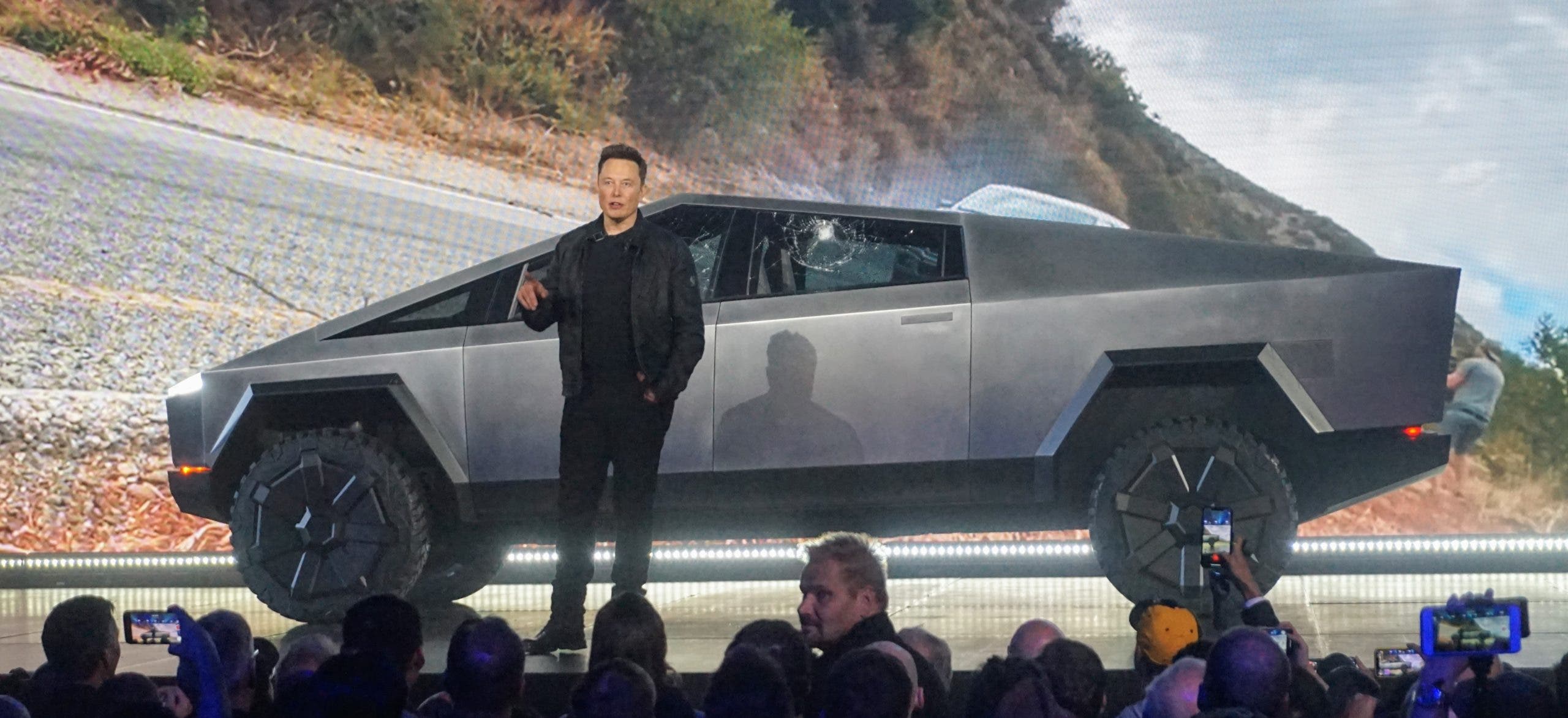

Battery Investor Day is less than two weeks away, but even without it, we see and hear a constant nudge about the future. I know about expansion in China, new factory in Texas, new factory in Germany, Cybertruck, Semi and Roadster start-up and we’re starting to push power generation. While it is clear that Tesla counts with its quarterly revenue, this also takes a clear back seat for its future plans.

Is it proof of the future of business?

One way or another, we’ll switch from fossil fuels. Tesla is on the brink of bleeding from companies making the transition for the sake of transmission, and could score huge milestones with network management.

Do I understand what they are doing?

Tesla’s goal is to accelerate the transition to sustainable energy. It achieves this by creating the most desirable compounds of any kind, while developing and implementing methods for creating and storing energy. Tesla has done this by encouraging a culture of innovation outside the standards of the industries in which they operate.

Am I too close to them?

I’ll admit, I’m very close to Tesla now – but I started investing in the company before that. I’m also very good at segmenting the things I love, while being able to admit flaws related to them. I think Tesla has a great product … but I can definitely say that I don’t invest in the company just because I like the product.

Long distance investing?

That was my last point, but I want to highlight it, because it was she who drove me to feel some tension. Right here What I wrote in my article on March 24th:

I originally called this “Don’t try to time the market,” but I think the real lesson is that you should never invest in a company that you don’t intend to keep for at least three years.

None of my beliefs about Tesla changed. I find myself a little wary about telling anyone else if they should invest in Tesla or not at the moment, as I didn’t think the seemingly normal increases of double the percent would continue, but I also didn’t think there would be any massive withdrawals.

Then yesterday, the combination of a $ 5 billion share sale announcement (which I love) and the news that Tesla is not adding to the S&P 500 (which I don’t care about at all) crushed the shares. She stressed on me.

I read a book about investing when I started – I honestly don’t remember which one, maybe I read 100 or more – and he said that if you are investing in a stock and believe in it, then when its price drops, you should consider it a “put for sale” and an opportunity to invest.

Conclusion

On September 8, Tesla was “put up for sale”, and it was a sale that I wasn’t expecting, so I didn’t have the ability to mix money to take advantage of that sale.

You may not agree. Maybe Tesla is just a house of cards, ready to collapse in on itself like many FUDsters – who seem to have suddenly gone out again – are claiming. My belief in the company’s outlook has gotten brighter (shout to sell stocks!), So viewing the drop as a sell-off I might have missed – the stock has recovered nearly half of its losses as I wrote this – is disappointing.

Tesla’s stock price is pressuring me … because I think I missed the sale.

Disclaimer

I am Tesla [NASDAQ:TSLA] A shareholder who has purchased shares in the previous 12 months. The research I’m doing for articles, including this one, may compel me to increase or decrease equity positions. However, I will not do so within 48 hours after publishing any article discussing matters that I feel may materially affect the share price. I don’t think my voice can or should affect the stock price on its own, and I would strongly caution anyone against using my business as your only data point to choose to invest or divest from any company. My articles are my opinion, and they are formulated using research based on publicly available data. However, my research or conclusions may be incorrect.

Do we appreciate CleanTechnica’s originality? Think about becoming a prof CleanTechnica member, supporter or ambassador – or patron on Patreon.

Register for free Daily newsletter or Weekly Newsletter So you don’t miss any story.

Do you have CleanTechnica advice, advertise, or guest suggestion on the CleanTech Talk podcast? Contact us here.

Latest Cleantech panel discussion

Communicator. Reader. Hipster-friendly introvert. General zombie specialist. Tv trailblazer