Chinese GDP grows 3.2% in next quarter

China’s overall economy returned to advancement in the second quarter, in a person of the world’s earliest symptoms of restoration from the fallout of the coronavirus pandemic.

Gross domestic product or service grew 3.2 for each cent in the 3 months to the finish of June, in contrast with the exact same period of time past 12 months, exceeding forecasts.

The figures follow the very first annual decline in a long time in the earlier quarter, when China’s GDP fell by 6.8 for each cent as the nation struggled to deal with the impact of the Covid-19 disaster.

The return to expansion coincided with a period of time when new described conditions of the virus had fallen sharply and larger condition guidance for the industrial sector, even as usage remained weak.

Liu Aihua, spokeswoman for the country’s National Statistics Bureau, stated the figures “demonstrated a momentum of restorative development and gradual recovery”. But she also pointed to “mounting exterior pitfalls and challenges” as the virus ongoing to spread globally.

“We are assured on the economic recovery in the 2nd half of this 12 months,” she included.

Knowledge from China, the place coronavirus was initial learned, is getting carefully viewed as economies all over the planet grapple with the effects of the crisis.

Inspite of regional outbreaks of the virus, which include final month in Beijing, new everyday scenarios have generally remained in the tens per day in the second quarter as the pandemic has collected speed in the US, Europe and Latin The us.

In April, China eased lockdown actions in Wuhan, the authentic centre of the virus, but has continued to enforce stringent policies on testing and closed off the state to most international flights.

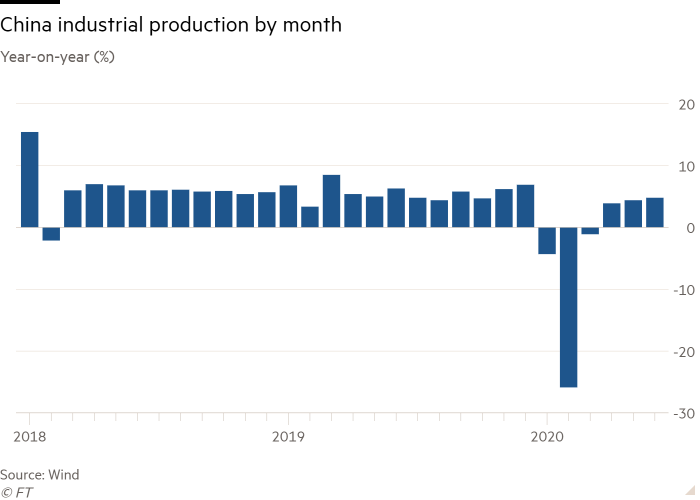

Soaring GDP in the 2nd quarter was assisted by robust industrial manufacturing, which enhanced 4.4 per cent as opposed with the exact same interval a 12 months before and rose in each of the earlier 3 months.

The Chinese point out has supported industrial action in excess of current months, in aspect by rising the sum nearby governments can borrow for infrastructure jobs. A rise in design has aided strengthen the country’s steel output when manufacturing has shrunk in other significant countrywide producers.

“In China the tale is really reliant on what is going on domestically,” claimed Louis Kuijs, head of Asia economics at Oxford Economics. “The momentum ought to be strong more than enough to make it rather unlikely [we] see another drop in GDP,” he extra.

Retail revenue fell by 3.9 per cent in the second quarter, signalling an uneven recovery and continued force on use. The unemployment charge in June was 5.7 per cent, a slight enhancement on May’s determine of 5.9 per cent.

Marcella Chow, international market strategist at JPMorgan Asset Management, pointed to the significant personal savings charges of domestic customers about the training course of the pandemic, but extra that intake could get better promptly if self esteem returned.

Newest coronavirus information

Comply with FT’s dwell protection and assessment of the world-wide pandemic and the speedily evolving economic disaster below.

China noted positive trade data this week, which showed exports unexpectedly climbing by .5 for every cent in June in comparison with last 12 months. But Ms Chow mentioned that external desire for Chinese exports could continue being weak as a end result of lockdown steps in Europe and the US.

Stocks in Asia-Pacific marketplaces retreated after the data were produced.

The CSI 300 index of Shanghai- and Shenzhen-detailed shares was down 1.6 per cent and Hong Kong’s Dangle Seng index fell by 1.2 per cent. In Japan, the Topix dipped .6 per cent and Australia’s S&P/ASX 200 was down .9, even though the Kospi in South Korea get rid of .6 for each cent.

“Markets Don’t like the unenthusiastic Chinese spenders,” Trinh Nguyen, senior economist for emerging Asia at Natixis, wrote on Twitter.

Added reporting by Alice Woodhouse in Hong Kong

Zombie aficionado. Typical introvert. General creator. Beer practitioner. Web fan. Music nerd.