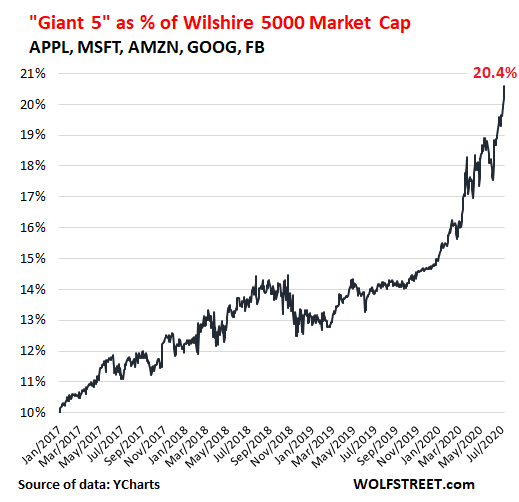

Buyers experience ‘a frightening, out-of-whack’ circumstance — just seem at this chart

If it weren’t for the “Giant 5,” your income would have been greater off sitting in income than the stock market above the past handful of many years, according to Wolf Richter of the Wolf Avenue web site.

Of course, financial investment gains since early 2017 have been completely dominated by Apple

AAPL,

, Microsoft

MSFT,

, Amazon

AMZN,

, Alphabet

GOOG,

and Facebook

FB,

to the level where the broader market, irrespective of some wild fluctuations, has delivered virtually absolutely nothing with out the upward drive of those stocks.

For some perspective on how this has played out, here’s what the Wilshire 5000, a marketplace-capitalization-weighted gauge of all U.S. stocks, has completed considering the fact that January 2017, minus the Big 5:

That’s right… very little.

“A miserable financial savings account would have outperformed the all round inventory market without the need of the Big 5,” Richter explained, “and would have performed so devoid of all the horrendous volatility of the two sell-offs.”

Examine:He hates shorting, but this ‘terrible, intestine-wrenching scenario’ has him executing it

In contrast, he stated the Big 5 Index has exploded for a gain of 184% around the same time frame, which has led to “breathtaking” market place capitalizations and dominance.

But, as Richter described, this can lower equally techniques. “That’s a terrifying believed — that this complete marketplace has become thoroughly dependent on just five giant stocks with an immense focus of energy that have now arrive underneath regulatory scrutiny,” he wrote. “And just as these shares pulled up the total marketplace, they can pull down the whole current market by their sheer bodyweight.”

The stock market place absolutely wasn’t pulled down in Friday’s upbeat buying and selling session, with the Dow Jones Industrial Regular

DJIA,

surging 369 details to conclusion at 26,075 and the S&P 500 Index

SPX,

introducing 33 factors to 3,185. The tech-weighty Nasdaq Composite

COMP,

banged out a third consecutive document shut.

Zombie aficionado. Typical introvert. General creator. Beer practitioner. Web fan. Music nerd.