Founder Sushiswap comes out of scams as sushi price lockers

The anonymous founder of Sushiswap was reported to have been scammed out of service after converting all of his sushi tokens to ETH On September 5th, reports of the alleged fraud came after the sushi token, which was forked from the Uniswap protocol, rose to $ 10 in just 24 hours.

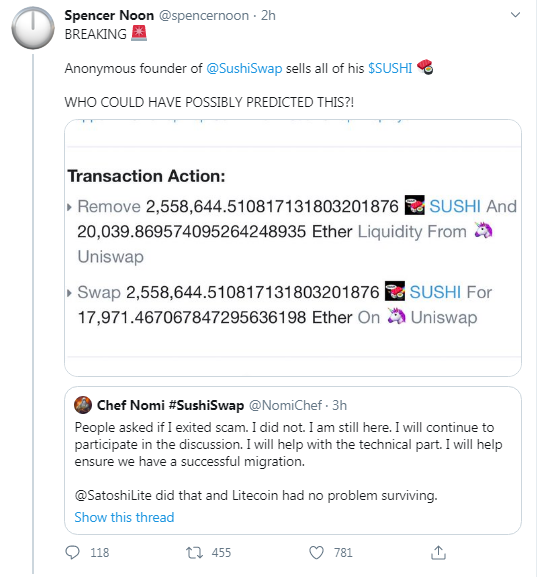

Twitter user Spensernoon first made Allegations.

However, in a seemingly complex chain TweetsChef Naomi, creator SushiwebHe denied the allegations. Content Creator Tweet:

People asked if I cheated out. I did not. I’m still here. I will continue to participate in the discussion. I will help with the technical part. I will help ensure we have a successful migration.

Then Sushiswap’s creator compares his actions to what Satoshilite (Litecoin’s Charlie Lee creator) did and how “Litecoin had no problem surviving”.

However, Chef Nomey appears to justify his actions and insist he deserves ETH:

“You might not think I deserved it ETH? I think my contributions justify that. You have written the migration code. You did all the audits. I have orchestrated the largest LP pool ever. You have created a large community. The 100s originated from LP scam projects. All this in one week. “

The Sushiswap creator is also making an effort to remind his critics of all the work he did on his own. The creator hints that the token’s price fluctuation has created unwanted pressure.

This is what I do. You have created an idea. You have created society. I did it better when I had no price under pressure. And if you believe in society. You believe in the idea. You stay. If not, you are free to leave. It is an open experience. The creator said the challenge.

Throughout the rest of the tweets, the founder described his actions as benign while complaining that “all I’ve received is blame and manipulation.

It was the symbol of sushi Included On the Binance platform on September 1 and according to reports, liquidity platform Defi managed to lock in funds of $ 1.2 billion. However, the token price is starting to decline, dropping 60% (in 24 hours) to $ 1.50 at the time of writing.

Meanwhile, Ethereum (ETHThe token appears to be taking a cue from the token’s drop after dropping 17% to $ 320 over the same period. The trend also appears to be the same with many other coins such as YFI, LEND, and LINK.

Chainlink LINK token likewise decreased double-digit from 19.7% to $ 10.19 while Polkadot token fell 28% to $ 3.83.

However, the rest of the market appears to have taken losses of 6% or less on average. Bitcoin has fallen below $ 10,000 over the same period.

What do you think of the alleged sushi exit scam? Share your thoughts in the comments section below.

Image credits: Shutterstock, Pixabay, Wiki Commons, Twitter,

DisclaimerThis article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, recommend or endorse any products, services or companies. Bitcoin.com It does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use or reliance on any content, goods or services mentioned in this article.

Communicator. Reader. Hipster-friendly introvert. General zombie specialist. Tv trailblazer