Partying like it is 1999 – Original community choices are again in Silicon Valley | Enterprise

Editor’s note: Some of our covid-19 protection is totally free for readers of The Economist Currently, our every day publication. For extra stories and our pandemic tracker, see our hub

THE IPO is useless, extended live the IPO. When the pandemic hit in March, initial public choices, significantly individuals by technological know-how startups, were predicted to be between the early victims. Soon after all, who wants to go public in a at the time-in-a-century disaster?

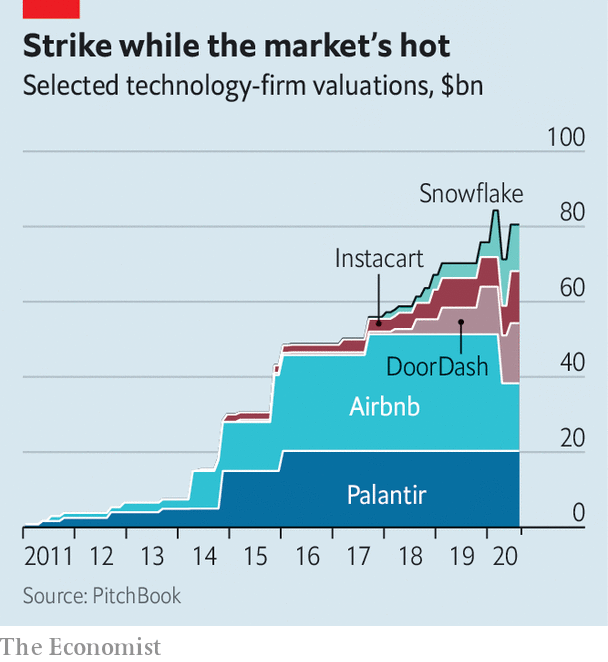

Quite a number of individuals, it turns out. In the past pair of months IPOs, which all but dried up until eventually late May, have occur again with a vengeance in The usa. None of Silicon Valley’s the latest and forthcoming listings rivals that of Ant Group. The payments affiliate of Alibaba, an on the net large, wants to raise a file $30bn in China by October, which could benefit the business at all over $200bn. But America’s technological innovation startups have introduced in $10bn so significantly this year (see chart 1)—and there is extra to occur. On August 19th Airbnb, which rents households to travellers, submitted for an IPO. Other privately held “unicorns” reportedly ready for general public pastures consist of Snowflake Computing, which will make cloud program DoorDash, which delivers meals and Instacart, which provides groceries. Increase Palantir, a cryptic facts-management company preparing for a immediate sale of existing shares in general public markets, and the latest blended valuation of these five is $80bn, in accordance to Pitchbook, a knowledge provider. Even if they float only a part of their shares, billions-value of fresh new tech stocks will quickly trade publicly.

This flurry of action has not reached dotcom-bubble territory from the convert of the century, when dozens of startups floated each and every thirty day period. But there is a whiff of “irrational exuberance” in the air, detects Lise Buyer, who has watched know-how shares because the heady late 1990s and now will help startups with IPOs at Course V Team, an advisory organization. When Duck Creek, an insurance coverage-tech organization, went general public on August 14th, it closed just about 50% better. BigCommerce, an on the internet-browsing platform which floated a week earlier, noticed its shares “pop” by far more than 200%.

With the S&P 500 index of massive American corporations at an all-time superior, never ever thoughts that covid-19 rages on, investors’ rationality is absolutely up for debate (see Buttonwood). But for lots of startups, the wish to go public is flawlessly rational, for two factors.

The initial has to do with the economic markets on their own. Undertaking capitalists who had been pouring billions into unlisted firms commenced to interesting on frothy startups ahead of the pandemic, immediately after a number of unicorn listings dissatisfied (Lyft and Uber) or collapsed (WeWork). At the similar time, rock-bottom desire charges are pushing community funds to seek out returns. As a consequence, stockmarket buyers are prepared to settle for substantial valuations, says Lauren Cummings of Morgan Stanley, an expense lender and a leading underwriter of IPOs. “There is insatiable demand by public buyers,” agrees Brian Feinstein of Bessemer Venture Companions, a undertaking-capital (VC) firm.

Startups are keen to slake it ahead of it dissipates. Many companies are as a result dusting off listing options that have been place on hold in the wake of the ride-hailing duds and the WeWork snafu. Their case is bolstered because—and this is the second cause for startups’ listing-lust—the pandemic has been a boon for many tech firms.

The 5 big platforms—Alphabet’s Google, Amazon, Apple, Facebook and Microsoft—have thrived as self-isolating people spend additional time and funds on the web, and corporations splash out on cloud-computing products and services to enable remote performing. On August 19th Apple briefly touched a market capitalisation of $2trn, the first American enterprise to do so. Not-so-big tech, way too, has benefited, which includes numerous corporations that have a short while ago absent public.

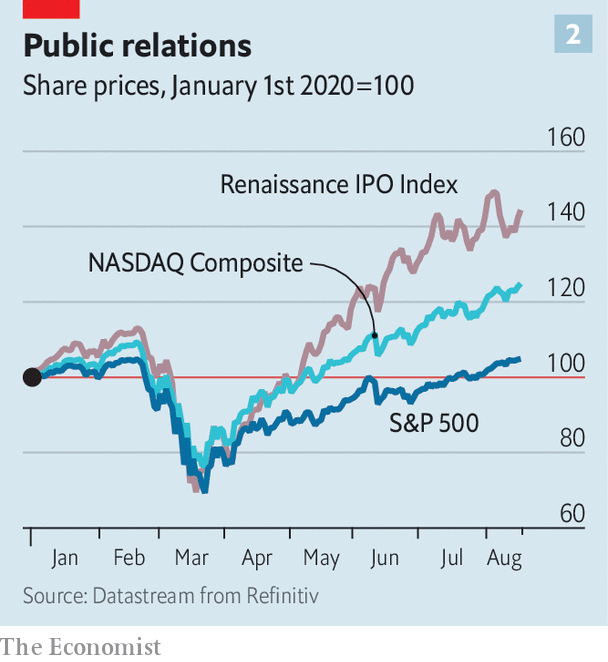

The pandemic has highlighted and sped up a elementary change toward electronic organizations, says Sarah Cannon of Index Ventures, a VC company. The trend will very last for many years, she predicts. Markets concur. The tech-weighty Renaissance IPO Index, which includes most listers of the earlier two decades, is up by additional than 40% considering the fact that January (see chart 2). Zoom, whose videoconferencing application has become ubiquitous amid lockdowns, has viewed its share price tag increase fourfold considering the fact that floating in April 2019 it is worth $78bn. CrowdStrike, a cyber-stability organization which shown in June past 12 months, has quadrupled in benefit due to the fact March.

One particular detail the most recent boom has done is spotlight how unhappy startups and VC corporations have grown with the existing procedure of heading community. It is cumbersome, with reams of paperwork, and can choose far more than a yr. It is also pricey—and viewed as too cosy for Wall Avenue. Investment decision banks’ costs alone consume up involving 4% and 7% of a normal IPO’s proceeds, not counting lawyers and other advisers. Startups and VC firms point to large to start with-working day pops as evidence that choices are underpriced to give banks’ huge investors a speedy return. Right after all, all those shoppers are regulars that must be retained sweet, whereas most startups only go public as soon as.

Disaffection with the IPO course of action, blended with a renewed motivation to go public, has led some firms to contemplate choices. A single is a “direct listing” of the type Palantir is pursuing, and which Spotify, a new music-streaming support, and Slack, a company-messaging business, have applied to great effect. Asana, which sells world wide web-based mostly challenge-management application, might be another unicorn to get the direct route. Direct listings use an electronic auction by the stock trade to get startups a fairer value for their shares than investment bankers could possibly. But they do not allow for corporations to elevate new revenue. As a consequence, they are an choice only for funds-abundant corporations.

Yet another route that has obtained prominence is the particular-reason acquisition enterprise. These SPACs, as they are recognized for short, are shell firms that go community promising to get a person or additional private firms with the proceeds from the listing. The non-public small business then fills up the outlined shell by a reverse merger. SPACs have a dodgy heritage lots of have underperformed the broader stockmarket. But the hottest lot guarantee to fix the flaws while preserving the gains, which include things like direct negotiations around the obtain value that can make bargains faster and extra predictable. From January to early August 60 SPACs went community, elevating $22.5bn. In July Monthly bill Ackman, a hedge-fund manager, launched a $5bn-7bn motor vehicle, the major so much.

It is unclear if Silicon Valley will embrace SPACs wholeheartedly. The major tech company to have utilised a single is Nikola, a secretive zero-emission-lorry startup which now offers a sector capitalisation of about $16bn. Several business people and their backers would resist letting their corporations be sucked up into a shell. But SPACs have a put in tech world. On August 18th Kevin Hartz, an early trader in Airbnb and Uber, introduced just one. Ribbit Money, a VC business, is reportedly preparing a different.

The IPO-industrial complex is not averse to immediate listings or SPACs, even if they are much less beneficial than the old-college methods. Bankers forecast a diverse potential of increasingly tailor-created flotations that, say, goal particular investors and predetermine how lengthy staff ought to keep on to their shares. As Greg Chamberlain of JPMorgan Chase, a lender, sums up, “Not all technology corporations are the very same. They have distinct objectives.” So long as startups want to hard cash in, as all ultimately do, they will want Wall Avenue to shepherd them through.■

This article appeared in the Enterprise portion of the print edition underneath the headline “Partying like it’s 1999”

Communicator. Reader. Hipster-friendly introvert. General zombie specialist. Tv trailblazer