The Milan Stock Exchange continues a mini-walk, the good Ferragamo, Autogrill, below the BFF Bank from Reuters

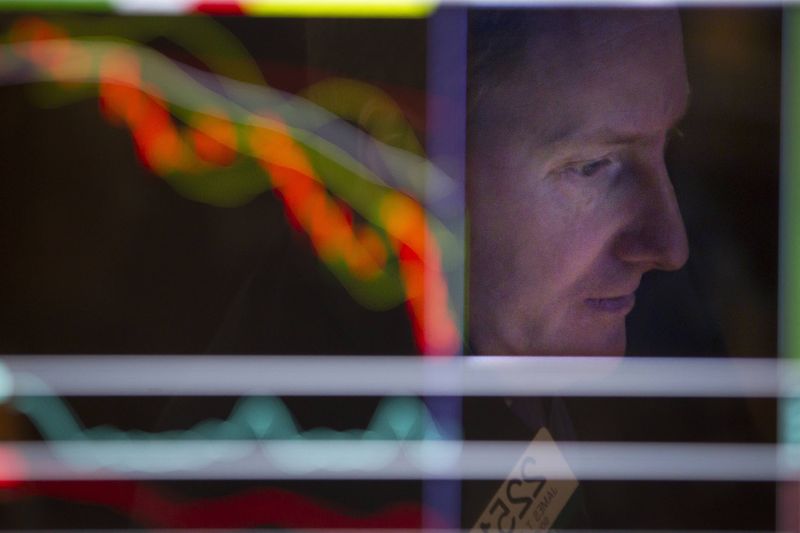

MILAN (Reuters) – Piazza Avary moves with a slight rise in indices to continue the mini rally in August always between sluggish exchanges and few stories being reported.

Asian bourses were not moved this morning, as concerns about the coronavirus delta variant and expectations of a possible “tapping” earlier than anticipated by the Fed prevail, partly clouding the strong results for the quarter.

There are also expectations in the markets for US inflation tomorrow afternoon.

Oil is recovering, just below $70 a barrel, after yesterday’s sharp drop, amid fears that new virus-related restrictions in China could slow global fuel demand.

In Milan, the index rose 0.25% at 9.45, well above the 26,000-point level, again at its September 2008 high.

Among the titles in the evidence:

Banks calmed down after the recent tears, with Bper (MI 🙂 continuing to correct and losing 0.6%. A similar drop is also in Banco Bpm (MI:).

In the rest of the sector, Small Mps (MI 🙂 moved after rating agency Dbrs downgraded subordinated debt from Mps to CCC from B (low) due to an increased risk that these bonds will be ‘burden’ involved as part of the potential acquisition of Sienese Institute by UniCredit.

There are very limited differences also for the big Unicredit (MI 🙂 and Intesa San Paulo (I:).

In the area of well-being, Ferragamo’s positive moment (MI 🙂 continues with an increase of 3.1%, adding to the 6.6% recorded yesterday. Traders are talking about rediscovering stocks that have been on the sidelines a bit from the upside in the markets lately. The volumes are roughly in line with the 30-day average.

In the sector also TOD’S (MI 🙂 which rose by 1.3%.

WeBuild grew 1.5% after subsidiary Cossi Costruzioni was the best bidder for three new contracts commissioned by Autostrade in l’Italia, with a total value of €210 million.

In the light too Buzzi Unicem (MI 🙂 (+0.9%) capitalized on expectations for today’s US Senate vote on the $1 trillion bipartisan infrastructure bill.

In the catering sector, Autogrill’s good moment continues, up 1.7% from its maximum since the end of July thanks to the impact of the moves on airports and highway restaurants in the summer period.

The oil sector, which recently suffered from the sharp drop in oil prices, is starting to fade, with Eni (MI) up 0.44% and Meyer Tecnimont (+0.6%) continuing its race to the upside. Contract award.

Intek was among the small companies (+2.3%) after signing the terms sheet with Aurubis AG to buy part of the flat-rolling production sector of the German group active in the supply of non-ferrous metals and in the recycling of .

Bff Bank extended its decline, down 3.8%, weighed down by weaker-than-expected second-quarter results.

(Giancarlo Navas, editorial staff at Milan Sabina Susie)

Communicator. Reader. Hipster-friendly introvert. General zombie specialist. Tv trailblazer